Generally, your insurer will certainly pay the rental business directly if they are partnered. If not, you typically have to pay in advance, and also the insurer will repay you up to your plan limits. If an additional vehicle driver created the damage for the protected loss, a rental cars and truck must be covered by their cars and truck insurance obligation protection.

If you have two vehicles and also just one has rental compensation insurance coverage, your rental cars and truck will not be covered if you sue under the auto that does not have this insurance coverage detailed. The rental quantity Additional hints covered and length of time varies by firm, policy as well as the quantity of time you are in fact without your vehicle, so make certain to read your policy and also remain in contact with your cases adjuster to recognize your limitations and responsibility.

The vehicle malfunction need to have been the result of a protected insurance coverage loss. As discussed above, a mechanical break down is normally not a covered insurance coverage loss. You or the other driver demand to have the ideal insurance policy protection in place. As pointed out, if another person was at mistake for the crash, the other chauffeur's policy will typically pay for your rental vehicle. car insurance.

It might be helpful and more prompt to utilize your own rental compensation protection and have your company subrogate the expense to the at-fault party rather (cheap car). On the other hand, if you were the at-fault vehicle driver, your policy might still spend for your rental offered you have included rental compensation protection.

Does automobile insurance consist of rental compensation protection? Rental compensation protection does not come standard in several car insurance coverage plans, however many insurance coverage providers provide it as an add-on coverage. insurers.

Some Known Details About Rental Reimbursement Coverage: When Will My Insurance ...

Do you need rental reimbursement coverage if you are not at mistake in a crash? If you are left without a lorry due to an accident one more person created, their obligation insurance coverage should action in to cover the cost of your rental auto. Typically, this protection will pay for a practical substitute, implying it may cover a car similar to the one you possess.

However, since determining mistake in a mishap can take some time, the majority of insurance specialists suggest purchasing your very own rental compensation coverage. If someone else is at mistake in a crash, you can utilize your own protection right away and afterwards have your insurance provider recuperate the expense for the rental vehicle from the at-fault party or their insurer once fault has actually been established.

You might have two lorries noted on your policy: a car as well as a vehicle (money). If just the car has rental repayment coverage added, but the vehicle is in an at-fault accident that requires a rental, the vehicle would certainly not obtain coverage for rental charges. A few other cases where rental car costs are not covered include: If you are gone out of community and intend to rent out a cars and truck at your destination, you will have to spend for it expense.

If you are left car-less due to the fact that of a mechanical issue, rental compensation insurance coverage does not tip in. Rather, it only spends for rental cars and truck expenses if your auto runs out commission as a result of a protected loss. Comparable to mechanical failure, if your cars and truck is in the look for basic upkeep, your auto insurance will certainly not cover the expenses for a rental in between that time.

cheaper auto insurance cheapest car credit cheapest car insurance

cheaper auto insurance cheapest car credit cheapest car insurance

It has its limitations, so insurance holders can not expect it to pay for all rental situations (cheaper auto insurance). In situations where you are in an accident as well as not at mistake, you might obtain coverage for a rental from the at-fault driver's insurance company, yet the process might take time.

Some Known Details About Rental Car Reimbursement Coverage - Progressive

Many insurance coverage experts suggest the insurance coverage as it will usually conserve you money if your cars and truck is damaged in a covered occasion (credit). If my vehicle breaks down, will insurance policy pay to tow it? If your car breaks down as well as you have roadside aid, your insurance might pay to tow it for repair work.

If you are appropriately insured on your own car, you may take into consideration discarding this added liability defense. If you have adequate wellness insurance and also special needs earnings insurance coverage, or are covered by individual injury defense under your own vehicle insurance, you will likely not require this added insurance.

auto insurance business insurance accident cheap insurance

auto insurance business insurance accident cheap insurance

provides for the burglary of individual items inside the rental vehicle. If you have a home owners or renters insurance plan, it normally covers this currently. If you regularly take a trip with costly jewelry or sporting activities tools, it might be a lot more economical to acquire a drifter under your residence or occupants insurance plan so the things are fully safeguarded when you travel - insurance affordable.

g., a week, a month or more), there might be limitations on the coverage your existing car insurance plan provides. Talk to your insurance provider or agent for information. If you do not own a cars and truck, you may intend to take into consideration purchasing a non-owner automobile insurance coverage, since it gives advantages along with coverage for a rental automobile.

The good news is, if you have rental compensation insurance coverage, your auto insurance may be able to assist. Yet when will your insurance policy spend for a rental cars and truck? Just how does leasing compensation coverage job, precisely? Today, we'll take a better check out this optional addition to your auto insurance plan, so keep reading! What is rental reimbursement protection? Exactly how does rental reimbursement protection job? Rental repayment coverage is a service given by the majority of insurance provider, and also is typically an optional addition to your existing protection.

10 Easy Facts About Insurance Company Providing A Rental Car - Mike Morse Law ... Described

Perhaps the engine passed away after 250,000 miles as well as requires to be replaced. In that situation, your insurance would certainly not cover rental reimbursement (low-cost auto insurance).

affordable car insurance cars risks accident

affordable car insurance cars risks accident

As a refresher course, let's take a quick look at what kinds of losses OTC and also Crash generally cover. Keep in mind, in case of a vehicle accident for which you are at fault, standard obligation insurance coverage only covers the other event's lorry (cheap car). In that same situation, Collision coverage would certainly spend for your vehicle too.

insurance money insured car cheaper cars

insurance money insured car cheaper cars

In such a case, you will require to talk to the at-fault insurance firm for details regarding the rate daily, as well as the size of time they're ready to cover (vehicle insurance). Their insurance provider will cover your rental for what they consider is a practical amount of time for the repairs to be full.

Is rental reimbursement worth it? It is obviously tough to anticipate just how commonly you might have a requirement for something like rental compensation insurance coverage; you can't extremely well understand if you're mosting likely to remain in a mishap in the future (credit score). Rather, it can be practical to think about how you may be influenced by a crash that leads to your car remaining in the look for a number of days.

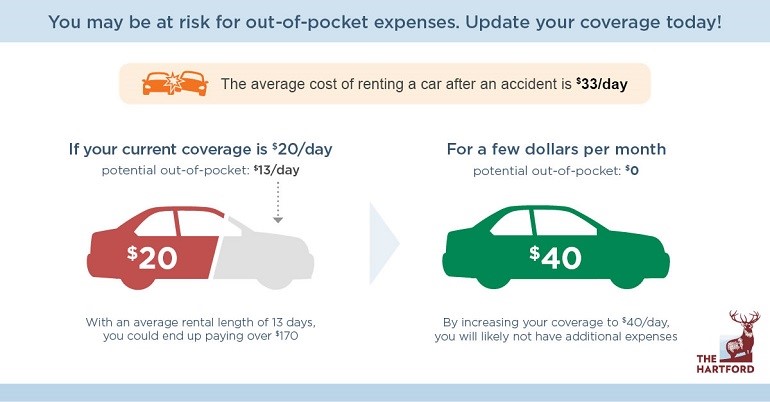

An economy class auto could only cost you $28 a day, while a high-end SUV can conveniently go beyond $35. Consider this thoroughly, as any unwanted of that everyday restriction will certainly have to be covered by you, the insured. Luckily, providers typically provide a wide variety of everyday limits for rental reimbursement, from as reduced as $20 a day up to $100 day.

The Best Guide To Should I Purchase Insurance From The Rental Car Company?

Obtaining a Rental Car after a Cars And Truck Mishap in Georgia, If you find on your own without transportation after a cars and truck crash, you may require to rent an automobile while yours is repaired or changed - low cost auto. We've offered this short article to assist respond to several of the most common questions regarding getting a rental vehicle in Georgia.

Who Pays for the Rental Vehicle? Their insurance adjuster can encourage if the insurance claim covers a leasing, and also how quickly you can obtain a rental auto.

In various other instances, the insurance provider will only repay you for the rental car. The rental company may still require you to put down a down payment with a credit rating card (cheaper auto insurance). This down payment should be refunded when the service is returned as well as billing is finalized with the insurer.

In this situation, it can be handy to utilize your own insurance policy if you have purchased rental protection. If you have this coverage, you can use that to pay for a rental vehicle up to the restrictions of your coverage (for instance, $30 each day for a maximum of $900) - business insurance.

What Automobile Rental Business Should I Use? If your rental auto is being billed directly to the at-fault chauffeur's insurer, you will certainly need to utilize the rental business that the insurance coverage business selects. You have a right to use any kind of rental supplier or area you choose, supplied that you might have to pay the cost upfront as well as seek reimbursement if you pick a various rental supplier.

Rental Car Reimbursement Coverage - Root Insurance for Dummies

What Type of Rental Car Should I Get? When using your own rental protection, you may desire to select an automobile with a lower daily price so that your compensation limit will certainly last longer - insurance affordable.

credit score vehicle cheap insurance car

credit score vehicle cheap insurance car

If you are paying for the rental cars and truck and also looking for reimbursement, ensure to authorize the rental rate with the insurer in advance. Additionally, make certain to lease a car that is similar to your own. In other words, if you have an economic climate car, don't go rent out a luxury cars and truck or pick-up vehicle, or else the insurance coverage business might refuse to cover the additional cost.

Do I Required to Acquire Added Insurance Coverage for the Rental Automobile? Most of the times, the short solution below is no. Your own thorough as well as accident cars and truck insurance should cover the rental vehicle all the same as it would if you were driving your very own automobile. Of training course, you must always validate this coverage with your private car insurance plan.

Contact your credit score card business to see what is and also is not covered before you determine whether to decline the additional insurance coverage - laws. For How Long Can I Keep the Rental Vehicle after the Automobile Mishap? If your auto is repairable, you can maintain the rental automobile for as lengthy as it considers your vehicle to be taken care of.

When Your Cars and truck is Repairable, If your cars and truck is repairable, you are qualified to a rental car for as long as it considers your auto to be repaired. If you are still able to drive the vehicle still, the insurer will begin covering a rental vehicle when the repair work facility starts dealing with your car - suvs.

The Buzz on If Your Car Breaks Down, Will Insurance Cover A Rental?

If the repair takes longer than expected, the rental company must collaborate with the insurance adjuster to extend your rental. Unlike with your own insurance coverage, there is no fixed time limitation for for how long the at-fault vehicle driver's insurance policy company has to pay for your rental vehicle while your lorry is being repaired (business insurance).