Just how much cars and truck insurance do you need? The answer relies on a number of elements, including where you live, just how much your vehicle is worth, as well as what various other properties you require to shield. Here's what you require to understand. Key Takeaways The majority of states need you to contend least a minimal amount of insurance policy coverage for any kind of injuries or building damage you create in a crash.

affordable car insurance car insurance cheap trucks

affordable car insurance car insurance cheap trucks

Comprehensive insurance coverage, also optional, protects versus other dangers, such as theft or fire. Without insurance motorist protection, necessary in some states, shields you if you're struck by a chauffeur that doesn't have insurance coverage. How Vehicle Insurance coverage Functions An automobile insurance plan is in fact a package of numerous different types of insurance.

low-cost auto insurance low-cost auto insurance cheaper cars cheapest

low-cost auto insurance low-cost auto insurance cheaper cars cheapest

As an example, if you possess your residence or have a significant quantity of cash in savings, a pricey crash can place them in jeopardy. Because situation, you'll intend to get even more coverage. The nonprofit Customers' Checkbook, amongst others, advises acquiring insurance coverage of at the very least 100/300/50, just in case. The difference in price between that insurance coverage as well as your state's minimum will possibly not be quite.

It's represented on your plan as the third number in that sequence, so a 25/50/20 plan would certainly supply $20,000 in insurance coverage. Some states need you to have as low as $10,000 or also $5,000 in building damages obligation coverage, however $20,000 or $25,000 minimums are most common. Again, you might want to get even more insurance coverage than your state's minimum (cars).

A commonly suggested level of home damages protection is $50,000 or even more if you have significant assets to shield. Clinical Settlements (Medication, Pay) or Personal Injury Defense (PIP) Unlike physical injury obligation protection, medical payments (Medication, Pay) or personal injury security (PIP) covers the cost of injuries to the vehicle driver as well as any kind of travelers in your cars and truck.

About Why Is Car Insurance So Expensive? - J.d. Power

Whether medical settlements or PIP insurance coverage is mandatory, optional, or also available will certainly depend on your state. In Florida, for instance, motorists must bring at the very least $10,000.

If you don't have health insurance coverage, however, you could want to acquire much more. That's especially real in a state like Florida, where $10,000 in insurance coverage might be poor if you remain in a severe crash - insurance. Collision Protection Collision coverage will pay to repair or change your cars and truck if you're included in a crash with an additional cars and truck or hit some various other things.

Nevertheless, if you have a car finance or are leasing the automobile, your loan provider might require it. When you have actually repaid your lending or returned your rented cars and truck, you can drop the protection. Even if it's not required, you might wish to purchase collision protection. For instance, if you 'd have problem paying a huge repair bill expense after a mishap, accident protection might be excellent to have. laws.

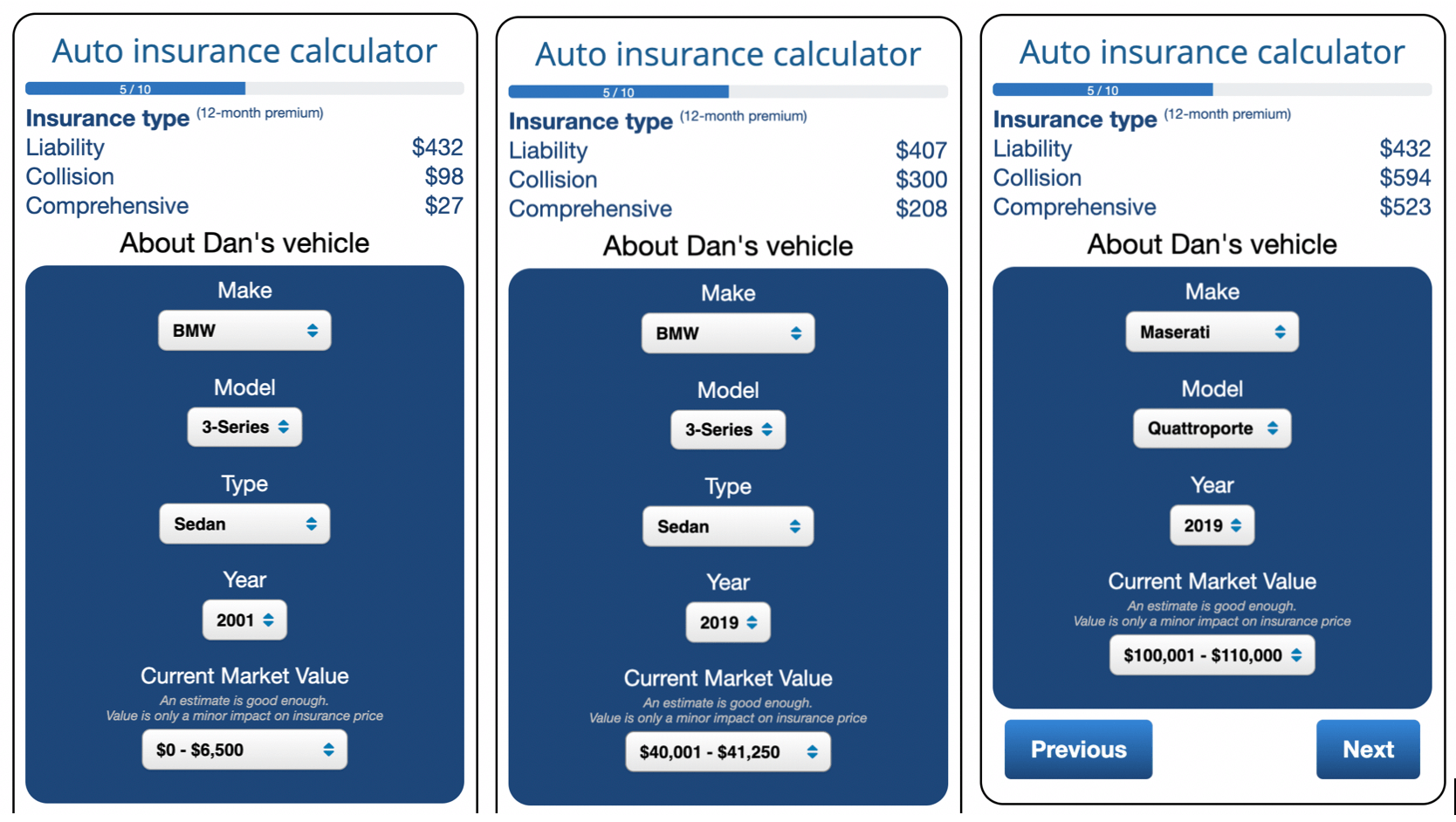

The price of accident insurance coverage is based upon the value of your car, as well as it normally comes with a insurance deductible of $250 to $1,000. So if your automobile would cost $20,000 to change, you would certainly pay the first $250 to $1,000, depending upon the insurance deductible you picked when you got your plan, as well as the insurance provider would be accountable for as long as $19,000 to $19,750 afterwards.

Between the price of your yearly premiums and also the deductible you 'd have to pay of pocket after an accident, you might be paying a great deal for very little insurance coverage. Also insurance provider will inform you that dropping crash protection makes good sense when your auto is worth much less than a couple of thousand dollars - insure.

The Of Car Insurance Coverage Calculator

It likewise covers cars and truck theft. As well as once again, when you've paid off your funding or returned your rented cars and truck, you can go down the coverage.

You'll also intend to think about just how much your automobile deserves compared with the expense of covering it year after year. Uninsured/Underinsured Motorist Insurance coverage Simply because state regulations require drivers to have responsibility protection, that does not indicate every chauffeur does. As of 2019, an approximated 12 (automobile). 6% of driversor about one in eightwere uninsured.

It can cover you as well as family members if you're harmed or your vehicle is harmed by a without insurance, underinsured, or hit-and-run vehicle driver. Maryland, for instance, calls for chauffeurs to lug uninsured/underinsured driver bodily injury liability insurance coverage of at least $30,000 per person as well as $60,000 per crash.

Every insurance firm has its very own proprietary rates as well as solutions for deciding what customers pay. Buying around can help you conserve a small lot of money sometimes (affordable). If you can't afford vehicle insurance policy, you shouldn't just drive without it, as it can be both unlawful as well as a massive risk to your funds.

One of the biggest factors for customers looking to buy cars and truck insurance policy is the rate. Not just do prices differ from firm to company, yet insurance policy expenses from state to state differ.

The Ultimate Guide To How Much Is Car Rental Insurance? - Enterprise Rent-a-car

Average rates vary widely from state to state. Insurance policy prices are based upon numerous standards, consisting of age, driving background, credit report, the amount of miles you drive annually, vehicle kind, and also much more. Relying upon ordinary auto insurance policy costs to approximate your auto insurance coverage premium might not be one of the most precise method to determine what you'll pay.

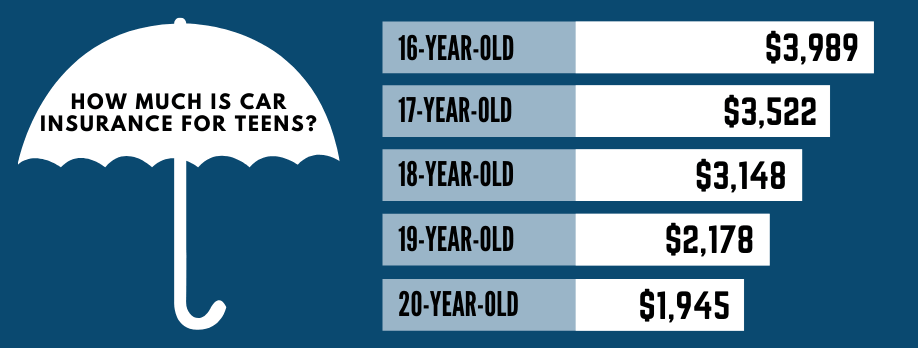

, and you might pay even more or much less than the average motorist for coverage based on your risk account. More youthful drivers are usually a lot more likely to get right into an accident, so their premiums are commonly higher than standard.

Keeping the minimum quantity of insurance your state needs will allow you to drive lawfully, and it'll cost less than full protection. prices. But it might not give ample protection if you're in a crash or your vehicle is harmed by one more covered event. Curious concerning exactly how the ordinary price for minimum protection piles up against the expense of full coverage? According to Insurify.

The only means to know precisely just how much you'll pay is to go shopping about and obtain quotes from insurers - car. Among the elements insurance providers use to figure out rates is area. People that reside in areas with higher burglary rates, crashes, and all-natural disasters usually pay even more for insurance. As well as because insurance policy laws as well as minimum protection needs vary from one state to another, states with greater minimum needs normally have higher typical insurance coverage prices.

Most however not all states permit insurer to use credit history when establishing rates. Generally, candidates with lower scores are more probable to submit an insurance claim, so they usually pay extra for insurance than chauffeurs with higher debt ratings. If your driving document consists of accidents, speeding up tickets, DUIs, or other violations, expect to pay a higher premium.

See This Report on What Is Gap Insurance? And What Does It Actually Stand For?

Every insurance firm has its own proprietary rates and solutions for deciding what customers pay. Shopping around can aid you save a small ton of money sometimes. If you can not pay for automobile insurance policy, you shouldn't simply drive without it, as it can be both prohibited and a significant risk to your funds.

Among the most significant factors for consumers looking to get car insurance policy is the rate. Not just do rates vary from company to firm, yet insurance policy prices from one state to another differ also. According to , the ordinary annual cost of vehicle insurance in the USA was $1,633 in 2021 and is forecasted to be $1,706 in 2022.

Ordinary prices vary widely from state to state. Counting on average automobile insurance coverage sets you back to estimate your automobile insurance costs might not be the most exact method to figure out what you'll pay.

, and also you may pay more or much less than the average driver for coverage based on your danger account. More youthful chauffeurs are usually more likely to obtain into a mishap, so their premiums are generally higher than average.

cheaper auto insurance cars insurance trucks

cheaper auto insurance cars insurance trucks

It may not offer ample security if you're in a crash or your lorry is damaged by another covered case. Interested regarding just how the typical price for minimum protection stacks up against the cost of full coverage?

Not known Factual Statements About Average Car Insurance Costs In April 2022 - Policygenius

One of the variables insurers utilize to identify prices is area - perks. And also considering that insurance coverage laws and also minimal insurance coverage requirements differ from state to state, states with greater minimum demands normally have greater average insurance prices.

Many yet not all states enable insurer to use credit rating scores when setting rates. In general, candidates with lower scores are more probable to sue, so they generally pay much more for insurance than drivers with greater credit scores. If your driving document includes mishaps, speeding up tickets, Drunk drivings, or other infractions, expect to pay a greater premium.

Every insurance firm has its very own proprietary rates and also solutions for choosing what clients pay. Purchasing around can help you conserve a tiny fortune in many cases. If you can not afford vehicle insurance, you shouldn't simply drive without it, as it can be both illegal and a massive risk to your funds - affordable.

Among the most significant variables for customers aiming to buy automobile insurance is the rate. Not just do costs vary from firm to firm, but insurance policy prices from state to state vary. risks. According to , the typical yearly price of auto insurance in the USA was $1,633 in 2021 and is predicted to be $1,706 in 2022.

vans cheap insurance accident liability

vans cheap insurance accident liability

Ordinary rates differ widely from state to state. Insurance policy prices are based upon several standards, consisting of age, driving history, credit rating, how numerous miles you drive annually, car kind, as well as extra - insurance company. Counting on ordinary vehicle insurance coverage costs to estimate your cars and truck insurance coverage costs might not be one of the most accurate way to find out what you'll pay.

The Ultimate Guide To Why Is Car Insurance So Expensive? - J.d. Power

, and you might pay more or less than the ordinary driver for protection based on your threat profile - cars. Younger drivers are typically more most likely to get right into a mishap, so their premiums are usually greater than standard.

It might not supply appropriate protection if you're in an accident Additional info or your automobile is damaged by one more covered event. Curious concerning exactly how the typical rate for minimum protection piles up against the cost of full insurance coverage?

One of the aspects insurance firms make use of to figure out rates is area. And also because insurance policy regulations as well as minimum insurance coverage demands vary from state to state, states with greater minimum demands commonly have higher ordinary insurance coverage expenses.

cheapest car insurance dui cheaper auto insurance liability

cheapest car insurance dui cheaper auto insurance liability

The majority of yet not all states allow insurer to utilize credit report when setting rates. In general, candidates with reduced ratings are most likely to file a case, so they typically pay more for insurance coverage than drivers with higher credit history. If your driving record includes crashes, speeding tickets, DUIs, or various other offenses, anticipate to pay a greater costs.